Official Business Penalty For Private Use

Having a private use rule is a good way to prepare yourself for the next phase of business ownership – managing money. While running a small business can be lucrative, it can also be very stressful and expensive.

For example, you have to pay for advertising and shipping charges for orders placed via your website or through a shopping app. You may have to calculate how many dollars you spend per order and whether or not it’s worth it since this may be your only source of income.

By having a private use rule, you can prevent overspending, wasted money, and overall happier spending habits. You can also develop the habit of spending only what you need since there will be no more buying buys that you don’t need.

The best way to add this rule to your personal policy is by adding one to your new personal account after signing up here.

Understand what constitutes misuse

It is important to know what misuse constitutes a penalty against your account. Penalties are applied depending on whether your use is malicious or not, inappropriate or not.

Penalties can be extremely expensive! So, it is important to know which uses do not require a password to determine if an account has a penalty. Examples of these uses include making small purchases without having to verify account status or using a pass-through payment method like PayPal instead of the owner’s personal account.

Things that do require a password are: using credit and debit cards, sending large amounts of money with an online payment provider, depositing money into an online bank account, and making large purchases with cash.

Understand what constitutes official business

In order to be considered business, your email address must be used in a productive and profitable way. In order for your use of the service to constitute profit, you must also be able to access and use the email system to send and receive messages.

Without using the system in a profitable way, such as sending promotional emails, you will not gain any purchase interest from your customers. You cannot justify paying for an email service by doing something like running an online clothing shop or selling electronic devices.

Some services offer a special exempt status that does not require either being officially engaged in business or being able to access and use the service in order to gain entry into the exemption. If these types of services have entrance requirements, they should be checked in order for an exemption to be granted.

Avoiding the penalty

A few small private use devices can cost a little money. If you are looking to purchase a new device or supplement your current device, there are cost-per-device and cost-per-month plans.

Both have their benefits and features, so this is up to you to decide which one works for you. Most of all, stay safe!

Look into ways of limiting your access to the internet and/or offline materials to help prevent yourself from having too much data left on your device. Having lots of data left on your device can also enter into the national security realm, so these things should be treated with care.

If you have to have cloud storage services for life, look into having single sign-on capabilities as well as reduced data usage plans.

Comply with tax laws

As a business, you must abide by tax laws and other laws that apply to you. For example, as a business owner, you must follow the regulations related to your business.

As a business owner, you may be required to register your business with the government. Furthermore, as a business owner, you may be charged corporate tax on income earned by your company.

Because of this, being aware of the law of your company can help lower the penalty that you may be required to pay corporate tax. A penalty is a financial cost that is imposed on someone for breaking law or rule.

There are several penalties that can happen for violating tax laws such as fine or imprisonment. Being aware of these penalties will help in making sure they are not missed.

Get help from an expert

Most of us can’t help but use our phones while we’re driving, so why not have the app that lets you get a ride without asking for a ride?

The app is called Getaround and can be downloaded from the Android or iPhone app stores. It works similar to a taxi-cab, with the driver as your call recipient and you as the passenger.

The passenger pays their driver via cash or card and the driver responsibilies for delivering the person to their destination. The get around app makes it easy to find a driver, they just download the app and try them out.

Another tip that gets people off of the road and away from smartphones is getting help off of public transportation. There are several apps that offer ridesharing extras such as cleaning or transportation services.

Useful tip: When looking for ridesharers, always ask for a price before agreeing to anything.

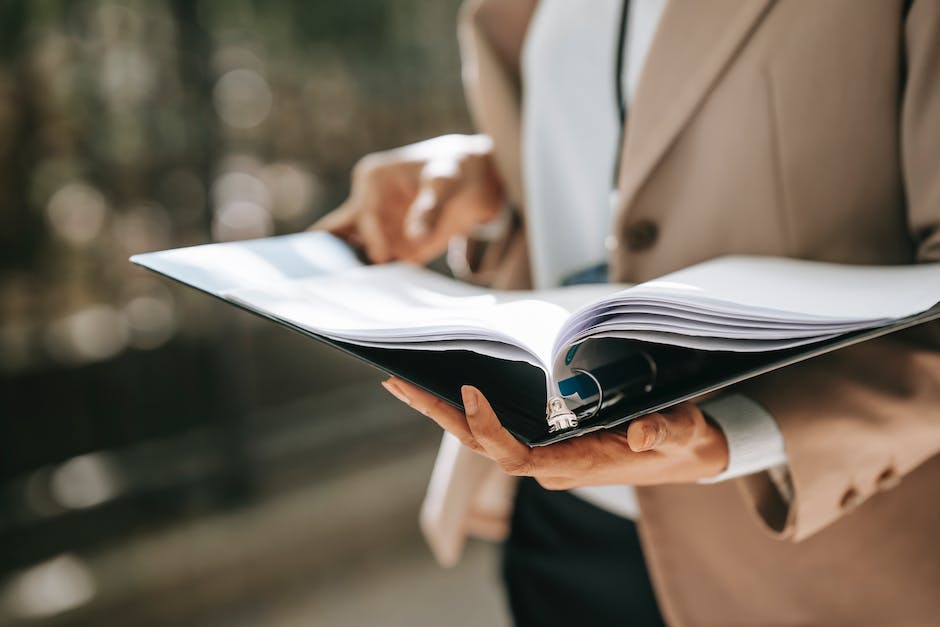

Know what documents to keep

As a business owner, you have a responsibility to help yourself and your company grow. Being productive can be hard when you are paying attention to other things like meeting clients or doing corporate business.

How much time you spend in your personal life should be considered part of your productivity score. A major point of penalty for being overly busy is not having official business documents.

Official documents such as business cards, letterhead, etc. should always be stored in an organized container with labels attached. By having these labels, you can find them easily if need to return them or send them out of state for processing.

If you have no official documents, then stay away from the computer and phone until you fix the issue that causes the problem. You can write down what you are doing and calling up any witnesses is a good way to fix the problem.

Avoid reckless behavior

Having a healthy respect for your company’s limits is essential for effective company policy development. When people exceed their allotted time or perform an unrecommended task, their time may be limited in the future.

It is for this reason that having a limited time budget is important. If someone exceeds their allotted time or performs an unapproved task, the appropriate team can easily tell whether or not it was worth it and what steps needs to be taken to ensure the quality of their work continues to improve.

When determining how much someone should get put on the private use charge, there should be a hard limit. If someone keeps breaking rules and abusing their privilege, they will eventually run out of reprisal and deserve a penalty that fits their crime.

Keep in mind that this does not mean you have to give out a full-blown punishment, but rather a warning that might help them self-regulate future actions.

Pay taxes on time

You can avoid paying taxes on income you receive from performing a private use use. You can do this by being on time in performing your obligations.

Many government programs are disorganized and lacking in transparency. As a result, there is a good chance you will be over-committed and taxed twice- regular annual tax season starts April 15th, and FICA holiday season runs from December 16th through January 1st.

If you are late with your payments, you have a good chance of getting your money back due to negative factor relief. Due to the high cost of being late, many people opt to be early.

However, if you are not going to be on time with your obligations, then you should consider paying extra tax for being in violation of law.